Real estate remains the most reliable and consistent investment irrespective of market conditions.

Why invest in private real estate?

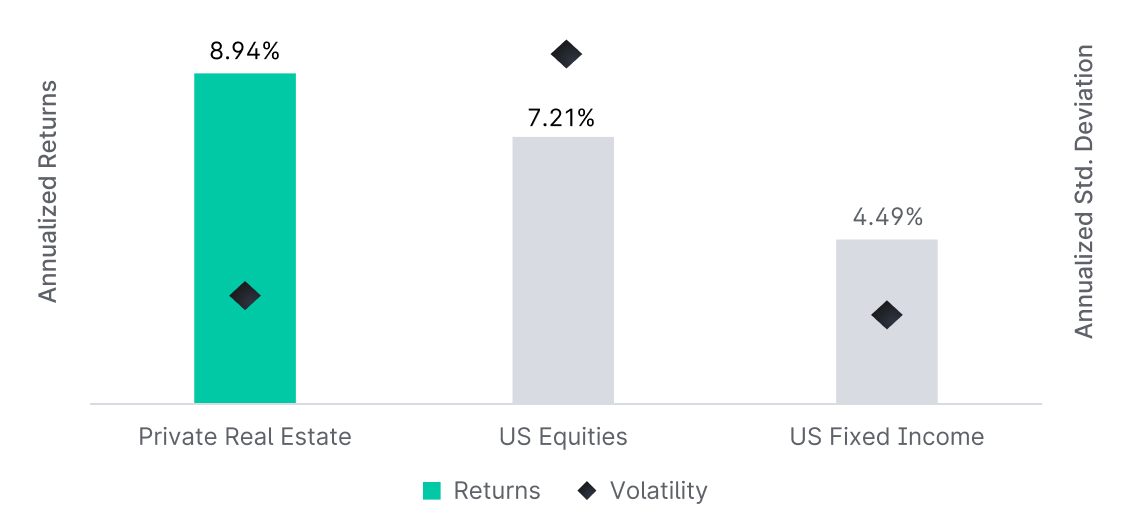

Private real estate has outperformed US equities and fixed income on an absolute and risk-adjusted basis since 2000.

Source: Yieldstreet and Bloomberg as of 5/31/2022. Annualized return and standard deviation are calculated on a quarterly basis from 1/1/2000-3/31/2022. “US Private Real Estate” represents the NCREIF Property Index. “US Equities” represents the S&P 500 Index. Past performance is not indicative of future results. It is not possible to invest directly in an index.

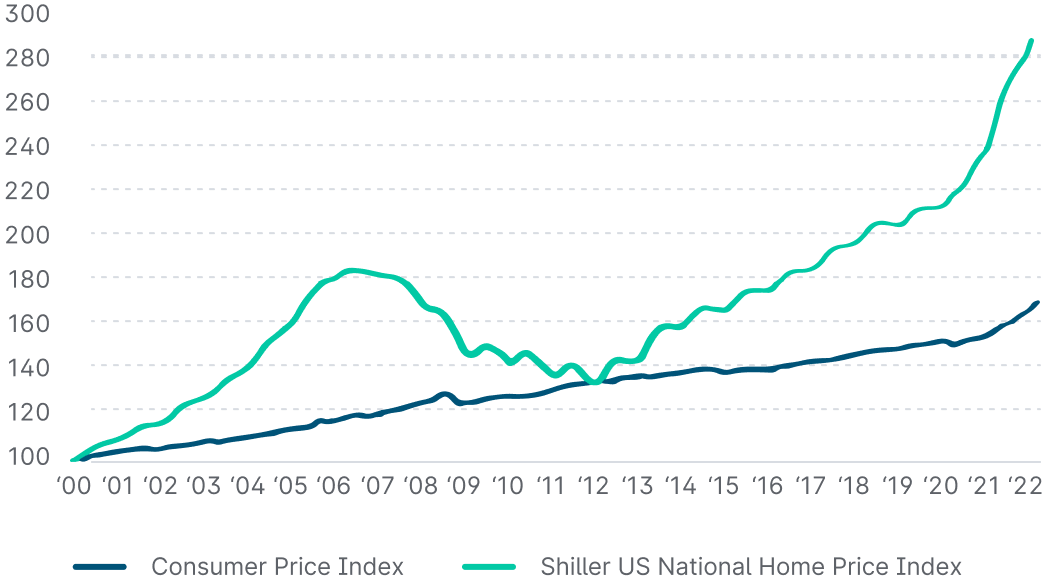

Real estate can provide a hedge to inflation

U.S. property prices and income have historically outpaced inflation, making real estate an attractive investment option.

Real Estate Income and Inflation | Indexed, 1996 = 100Rent growth is represented by real estate net operating income; NCREIF; inflation; Moody's Analytics; 01 Jan - 31 Dec 2021 (based on most recent data available). Past performance is not indicative of future results. It is not possible to invest directly in an index.

How is investing in MSL Capital different?

All real estate opportunities undergo a stringent multi-step vetting process designed to comprehensively review them from various risk lenses. This vetting process ensures a resilient investment structure that seeks to minimize surprise.

-

Our team’s experience in real estate development, acquisitions and operations is a unique value-add. With proven outsized returns for investors, MSL is a reliable partner to our investors.

-

MSL Capital acquires and manages multifamily value-add properties. All data indicators show strong short and long-term residential rental demand that provides strong annualized distributions to our investors.

-

Investors can track the fund’s performance and their actual and expected returns at any time using our investor portal. MSL Capital even has a convenient mobile app investors can use to access all important tax documents, fund performance reports and distribution and transaction history.

-

MSL Capital’s strong local partnerships and relationships give our investors access to real estate’s most coveted deals, whether off-market or overlooked.

“A unique opportunity exists with Multifamily product that sees a short and long term strong residential renter demand and attractive buying opportunities on the underlying asset.”

— Mohammad Bataineh, CEO, MSL COMPANIESFundamentals of Real Estate Investing:

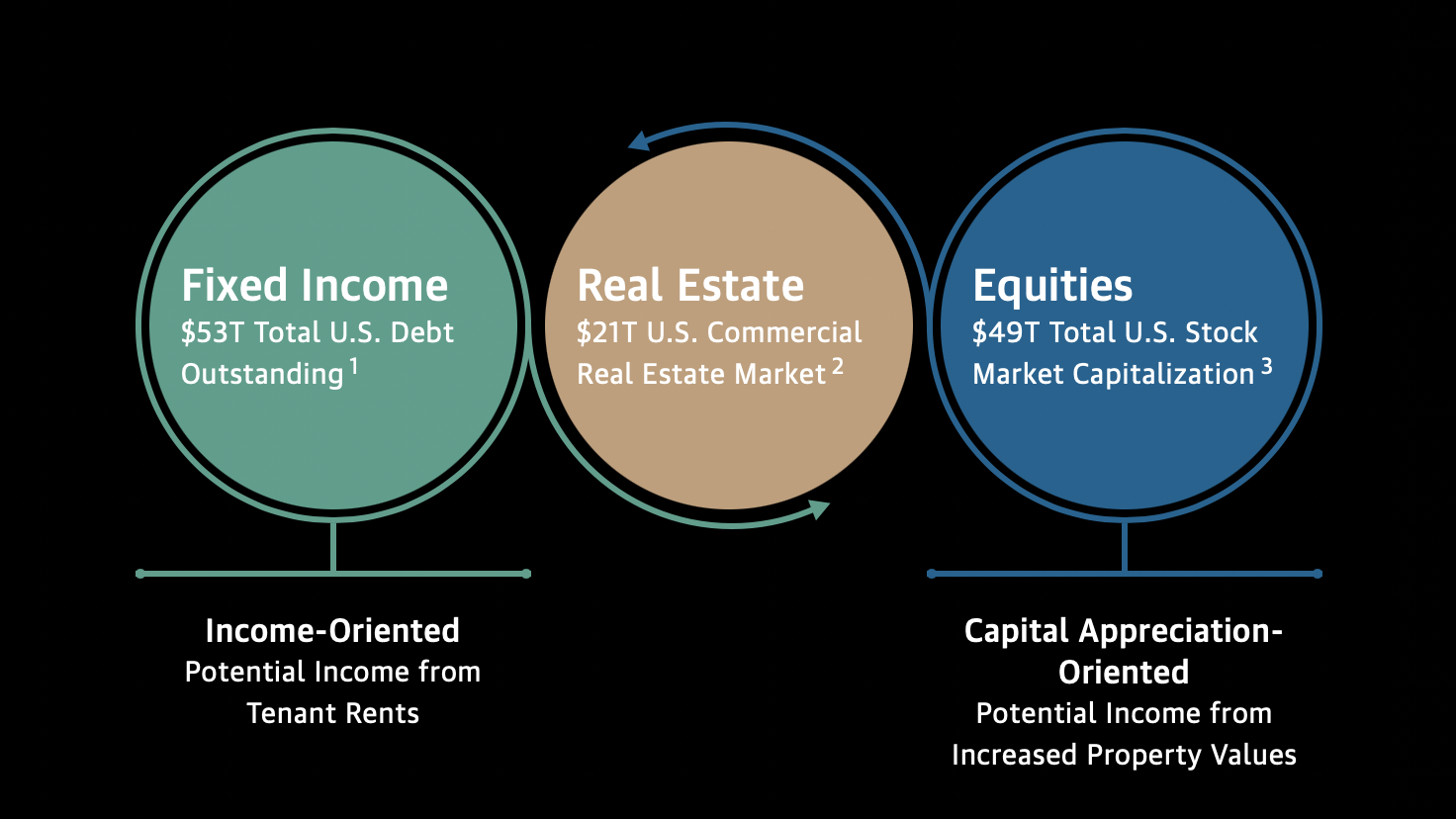

ASSET CLASSReal estate is the third largest asset class behind fixed income and equities

Unlike stocks or bonds, real estate is both income-oriented and capital appreciation-oriented

INCOME CONSISTENCYOver the last 20 years, real estate consistently distributed income

>5%

Private real estate has distributed income of at least 4% over 18 of the past 20 years, and never below 2%

Performance data shown represents the performance of an index and not that of MSL Capital. There is no assurance we will pay distributions in any particular amount, if at all. It is not possible to invest in an index.

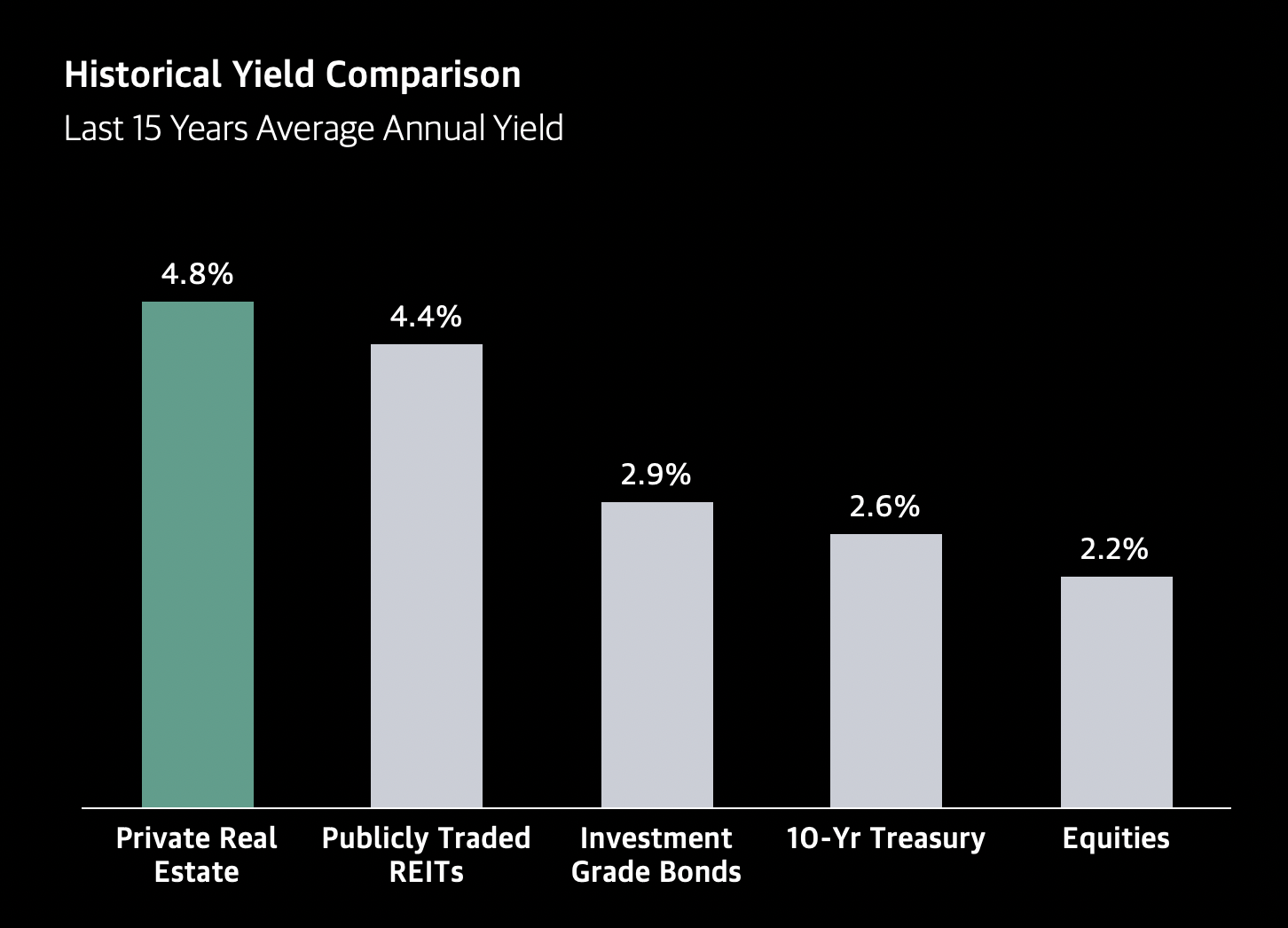

SOURCE OF INCOMEIncome derived from private real estate has exceeded that from other asset classes

Last 15 Years Average Annual Yield income from private real estate has been higher than income from publicly traded REITs, investment grade bonds, the U.S. 10-Year Treasury yield, or equities

RETURNS & RISING RATESU.S. private real estate values generally have increased during periods of rising interest rates

Rising interest rates have historically suggested improving business activity, which benefits real estate through improving occupancy levels, higher rents, and/or higher net cash flow

As a result, real estate has generally generated favorable returns in inflationary and rising rate environments